One of my personal favourites and a service I use often is TransferWise (transferwise.com), started by the Estonian people who brought you Skype. It’s a ‘peer-to-peer’ money exchange service. Estonia is without doubt the most technologically advanced country in Europe, and the guys behind TransferWise do a lot to help the reputation. Just as Skype used millions of computers to provide a solid communication network, utilizing the power of them all to provide a stable communication platform, TransferWise does the same with money.

One of my personal favourites and a service I use often is TransferWise (transferwise.com), started by the Estonian people who brought you Skype. It’s a ‘peer-to-peer’ money exchange service. Estonia is without doubt the most technologically advanced country in Europe, and the guys behind TransferWise do a lot to help the reputation. Just as Skype used millions of computers to provide a solid communication network, utilizing the power of them all to provide a stable communication platform, TransferWise does the same with money.

As you are probably painfully aware, if you transfer money between currencies, you’ll be charged some pretty hefty fees for the privilege by your bank(s). TransferWise, very simply, allows you to pay into one of their accounts in one currency, then they pay you, using a fixed rate from xe.com from another of their accounts in the target currency. They charge a fee, of course, and it’s deducted at source, so when you want to send money, all you’ll see is the two currency amounts and the total of your saving. It can do this because there are multiple clients at any one time whishing to exchange currency. If you want to change 1,000 dollars into euros, they’ll look for someone else looking to change euro to dollars and swap the cash between you, transparently. For the thousand-dollar figure mentioned earlier, the cost would be around $10 – a saving of around $60 compared to a regular bank.

Now we’ve saved you hundreds of euros, what to spend it on? Well, if you fancy a real gamble but don’t like the horses or ball games, how about taking a shot at crowdfunding? The two biggest names are probably indiegogo.com and kickstarter.com.

The premise is simple: help to fund a project and receive benefits for doing so. Most projects will offer various incentives for investment, from a hearty ‘thanks’ to finished versions of the product or medium. Keen-eyed readers will note the use of ‘spend’ earlier in the text. That’s because the benefits you may receive – should the project ever be completed – rarely outweigh the money invested. You will rarely, if ever, be offered a piece of the action in the form of company shares but it may give you a warm and fuzzy feeling inside for a while.

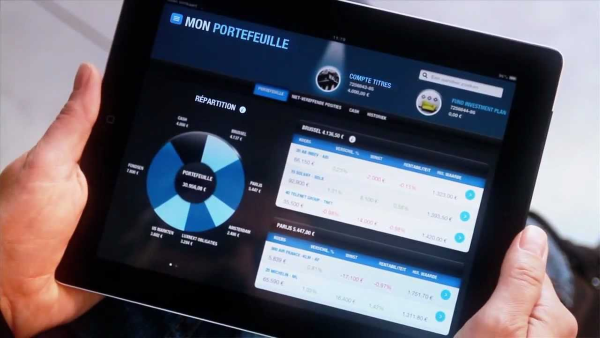

Income, outgoings, spending, saving – how do you keep track of it all? One way would be to use mint.com, an essentially free service. Principally a budgeting tool, Mint provides 24/7 online access to your finances. It will alert you to upcoming bills by SMS or email, help you with setting a budget and provide you with tools to help you keep a tight reign on your money. The free lunch principle applies here, as it will offer you various ways to invest or save money and you may optionally pay a small fee to access your credit score. The occasional advert will pop up too. If none of these things bothers you particularly, Mint remains free to use and can be used from any browser as well as its dedicated apps for Android and iOS.